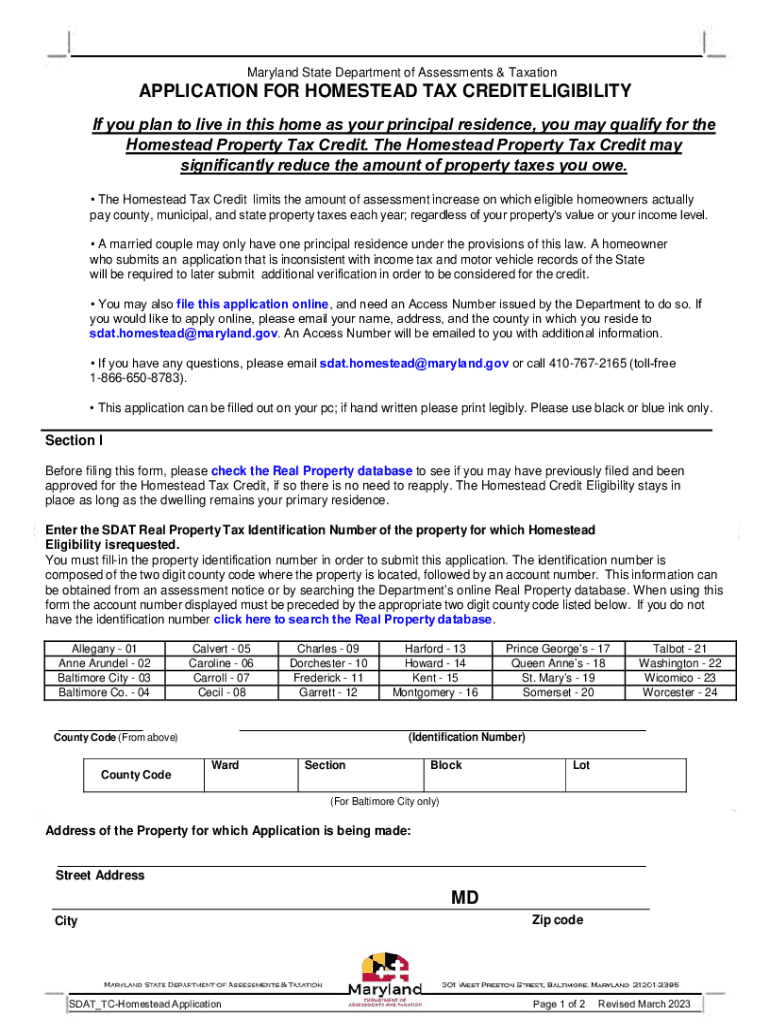

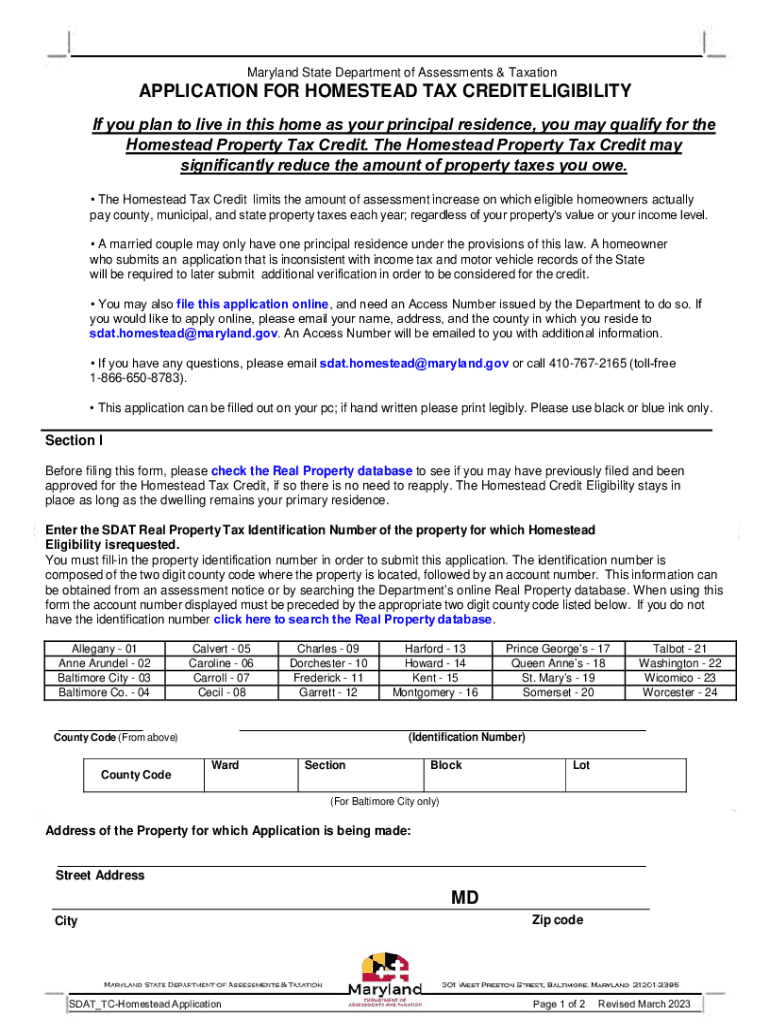

MD SDAT Application Homestead Tax Credit Eligibility 2023-2024 free printable template

Get, Create, Make and Sign

How to edit maryland application homestead online

MD SDAT Application Homestead Tax Credit Eligibility Form Versions

How to fill out maryland application homestead 2023-2024

How to fill out maryland application homestead

Who needs maryland application homestead?

Video instructions and help with filling out and completing maryland application homestead

Instructions and Help about tax property maryland form

Hey folks might Greg in with a migraine I'm selling team happy 2014 looking forward to a great 2014 and again this year were committed to providing you updated great information on the real estate market also important topics the one topic that were going to go through today is a question that I'm getting asked a lot especially this time of year, and it's the homestead exemption first what is it the homestead exemption it's an exemption that's given by very taxing authorities counties cities school districts, and it removes part or all of your taxes that you pay there's in essence there's four different taxes or four different exemptions that you can qualify for one is a general homestead exemption which most people are familiar with the over five exemption which can be very important if you are is you know someone that's 65 to make sure that you follow the guidelines that do that in the timeline that set out there's the disability exemption and then there's also a military or veteran disability exemption these are important especially now in an appreciating market because this can significantly decrease the amount of taxes that you're going to pay on your property right now in the Houston market were continuing to go up tax values have been flat for the most part for the last several years last year they started to go up our expectations are they're going to go up this year and really continue to go up last year mine went up 10 which is a maximum, and then it went up we had installed a pool last year, so it went up what they value the pool lap, so it's the maximum that thing can go up is 10 plus any improvements you want to be aware of the exemptions that you qualify for and go on and make sure that you have every one that you qualify, so you can get the discounts that you're allowed if you have any questions on which ones that you should be getting or if you qualify for certain Warrens feel free to give me a call be happy to talk with you show you where to go, or you can go on online with you take a look you can call me you can email me whatever is more convenient for short were going to be coming out with our projections and our predictions for 2014 just giving a hint its another good-looking year were going to go over some information on that and well be back with you soon have a great week look forward to talking with you soon and have a good day

Fill maryland application homestead tax credit online : Try Risk Free

People Also Ask about maryland application homestead

For pdfFiller’s FAQs

Below is a list of the most common customer questions. If you can’t find an answer to your question, please don’t hesitate to reach out to us.

Fill out your maryland application homestead 2023-2024 online with pdfFiller!

pdfFiller is an end-to-end solution for managing, creating, and editing documents and forms in the cloud. Save time and hassle by preparing your tax forms online.